CUHK FinTech Competition on

“How Agentic AI Can Disrupt or Revolutionize Financial Business Models”

We are excited to launch the CUHK FinTech Competition 2026, themed “How Agentic AI Can Disrupt or Revolutionize Financial Business Models.”

This year’s competition is proudly co-organized by the Hong Kong Monetary Authority (HKMA) and CEFAR, and sponsored by Hang Seng Bank and Cyberport. Their support enables us to foster innovation and empower students to explore the future of finance through Agentic AI.

To inspire participants, we kicked off with two insightful sharing sessions:

- “Responsible Innovation” delivered by a representative from HKMA (13 Jan 2026)

- “AI Applications in Financial Service” delivered by a representative from Hang Seng Bank (20 Jan 2026)

Both sessions provided students with valuable industry perspectives—from responsible AI adoption to practical financial AI use cases—setting a strong foundation for the creative solutions they will develop.

Key Dates

- Final Competition & Selection at CUHK Campus: 19 March 2026

- Visit to HKMA Information Centre: 15 April 2026

- Prize Presentation at Hang Seng Bank Headquarter Penthouse: 28 April 2026

FINTECH SEMINAR

Topic: FinTech Innovation@ASTRI

Date: 27 Jan 2026

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, H.K.)

Abstract

FinTech innovation at ASTRI explores transformative applications of generative AI, advancing secure and privacy centric solutions while building resilient data and asset platforms. This presentation highlights how these technologies converge to drive trust, efficiency, and scalability, empowering financial ecosystems with intelligent automation, regulatory compliance, and future ready digital infrastructure.

Speaker(s)

- Dr. Alan Cheung, Chief Director, Artificial Intelligence and Trust Technologies, Hong Kong Applied Science and Technology Research Institute (ASTRI)

SNAPSHOTS

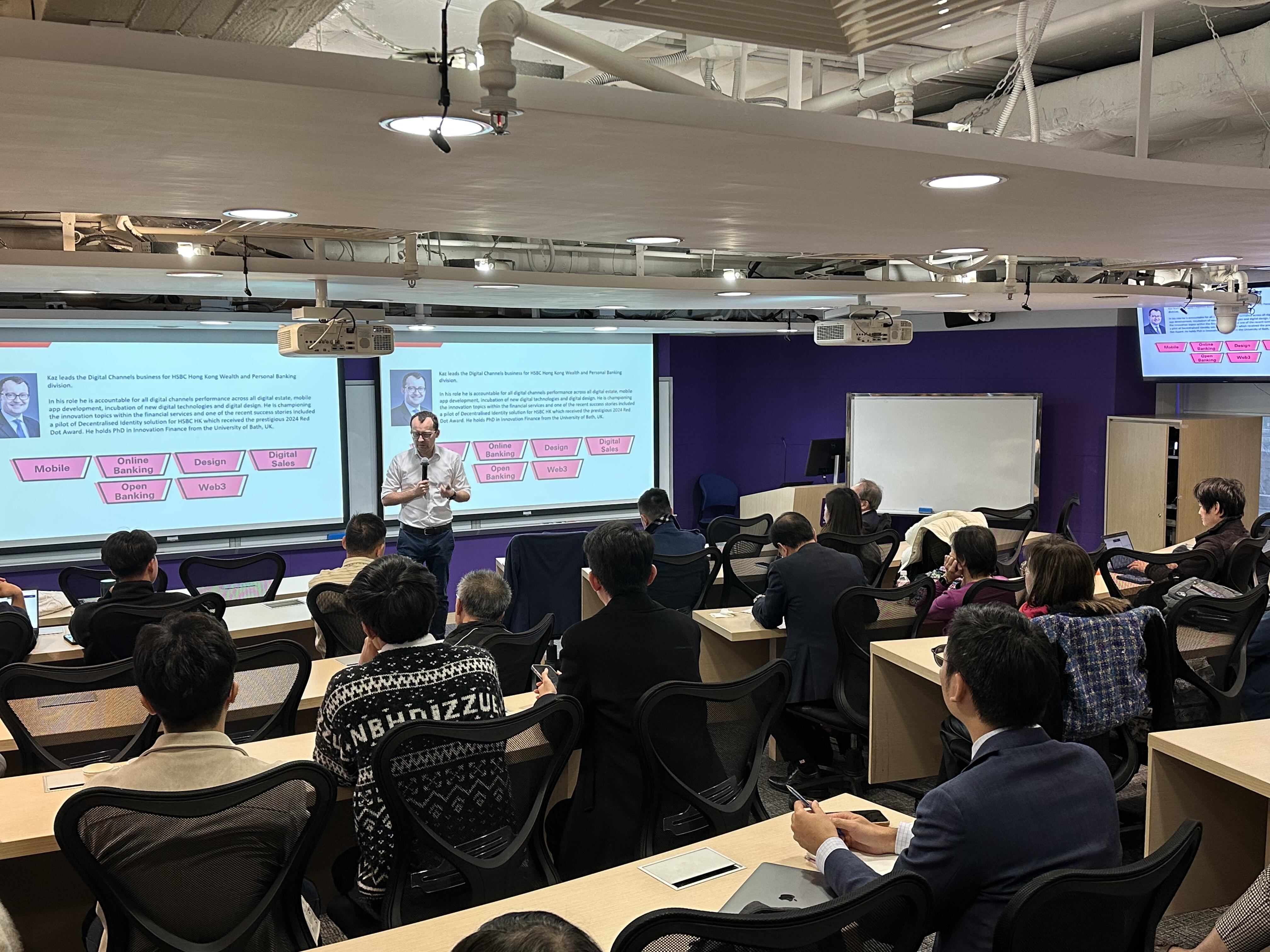

FINTECH SEMINAR

Topic: Digital Innovation in Financial Services - The Role of AI

Date: 25 Nov 2025

Time: 5:30pm - 6:15pm

Venue: CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

Digital innovation in financial services is poised to accelerate over the coming few year, largely driven by the accelerated development of artificial intelligence (AI) and the advances in processing power. In this seminar, we will be exploring likely areas of development and its implication in retail financial services.

Speaker(s)

- Dr. Kazimierz KELLES-KRAUZ, Head of Digital Channels and AI Hong Kong, WPB, HSBC Hong Kong

SNAPSHOTS

CEFAR MentorShip Programme Networking Dinner

To enhance communication between mentors and mentees, the CEFAR Academy hosted a mentorship program networking dinner on December 17, following the Fintech Seminar Series. This event served as an excellent platform for students and mentors to connect, exchange insights, and build lasting relationships.

Our mentors, who are prominent leaders in the fintech industry, provided invaluable guidance and support to our mentees, recipients of the TPg Fellowship Scheme. This assistance helped them navigate their career paths and explore new opportunities. The mentorship program is designed to connect students with industry and fintech leaders to advance their career goals and foster personal growth.

FINTECH SEMINAR

Topic: Digital Innovation in Financial Services – What’s on the Horizon

Date: 17 Dec 2024

Time: 5:30pm - 6:15pm

Venue: CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

Digital innovation in financial services is poised to revolutionize the industry, driven by convergence of multiple technologies each with their own maturity path such as artificial intelligence (AI), 5G, cloud computing, decentralized identity and the Internet of Things (IoT). AI and cloud computing are at the center of the latest wave of technology driving how information is process, combined with integration of 5G and IoT that is bridging the gap between physical and digital financial worlds, additionally, privacy-enhancing technologies (PETs) and decentralized identity are enhancing and creating new ways of data access and security. Adoption of these technologies are creating powerful clusters to reshape financial services, and collectively can offer new opportunities for businesses that will benefit customers.

Speaker(s)

- Dr. Kazimierz KELLES-KRAUZ , Head of WPB Digital Channels, Hong Kong , The Hongkong and Shanghai Banking Corporation Limited

Snapshots :

MOU signing ceremony between CUHK and HSBC Software Development (Guangdong) Limited (HSDC)

The Chinese University of Hong Kong CUHK)’s Engineering FinTech Applied Research (CEFAR) Academy and HSBC Software Development (Guangdong) Limited (HSDC) have signed a Memorandum of Understanding (MOU) on 16 December. This partnership aims to foster collaboration, groom young talent, and contribute positively to the community. This MOU marks a significant strengthening of the relationship, and we look forward to the incredible opportunities this collaboration will create for our students and the broader community.

For more information, please visit :

Faculty website https://www.erg.cuhk.edu.hk/erg/node/2787

CEFAR LinkedIn https://www.linkedin.com/in/cefar-cuhk-525032310/

FINTECH SEMINAR

Topic: Digital Assets - A Perspective from Venture Capital Investment

Date: 19 Nov 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

The digital asset market is experiencing rapid growth, driven by permissioned and permissionless infrastructure that allows for the swift creation and trading of new assets. The opportunities will impact every aspect of our traditional financial world and will create growth through its versatility, and with promises in cost reduction and efficiency improvement. Despite the opportunities, the digital asset market is not without its challenges. Key obstacles include regulatory uncertainty, market volatility and adoption. This environment mirrors traditional VC, where investors can engage with projects early on, fostering strong network effects that enhance sustainability and growth. We will discuss the development of selected areas of digital assets from a VC perspective.

Speaker(s)

- Dr. Frank Tong Fuk-Kay, Managing Partner, QBN Capital

Snapshots :

2024 CUHK Conference on Financial Technology themed

The Booming Green FinTech Sector

For more details, please visit : conference.cefar.cuhk.edu.hk

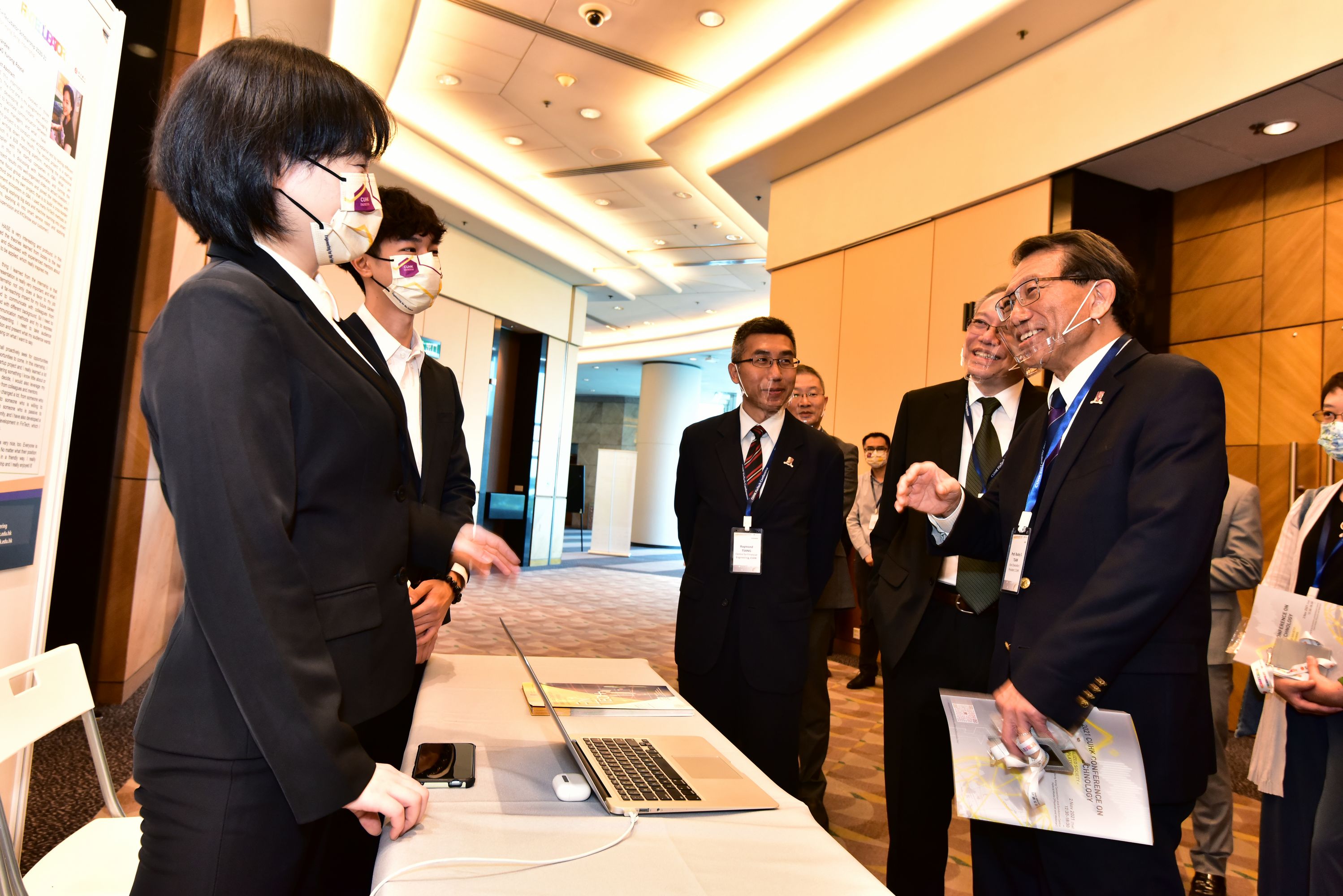

The Chinese University of Hong Kong (CUHK)’s Faculty of Engineering hosted earlier the 2024 CUHK Conference on Financial Technology, attracting nearly 300 attendees, including government officials, regulators, industry practitioners, academics, researchers and students, to delve into the transformative world of fintech. Sponsored by IBM China/Hong Kong Ltd., Hang Seng Bank and Deloitte China, the conference was themed “The Booming Green FinTech Sector”, highlighting innovative strides to merge financial technology with sustainable practices and discover cutting-edge solutions. It also served as a networking platform for industry leaders to drive a greener, more sustainable future.

The officiating guests included Professor Rocky S. Tuan, Vice-Chancellor and President of CUHK; Ms Lillian Cheong, Under Secretary for Innovation, Technology and Industry of the Hong Kong government; Professor Tsang Hon-ki, Dean of CUHK’s Faculty of Engineering; Ms Mimi Poon, General Manager, IBM China/Hong Kong Limited; Ms Nancy Cheng, Head of Partnership and Innovation, Hang Seng Bank; and Mr Robert Lui, Hong Kong Digital Asset Leader, Deloitte China. Mr Joseph H. L. Chan, Under Secretary for Financial Services and the Treasury of the Hong Kong government, delivered the keynote address.

During the conference, experts from the banking, technology and legal sectors, together with CUHK scholars, participated in four panel discussions and a series of featured talks, sharing insights on integrating financial technology with environmental responsibility.

In his welcome remarks, Professor Tuan said: “Green fintech is paving the way for a more sustainable economy. To support sustainable development, Hong Kong needs skilled fintech professionals. CUHK is proud to offer the city’s first bachelor’s and master’s degrees in fintech, and we work closely with regulators and industry partners to offer real-world experience to our students.”

Mr Chan remarked that the government aims to attract and rapidly develop talent: “It is important to groom talents to support the sustainable development of fintech and green finance. We have launched the Pilot Green and Sustainable Finance Capacity Building Support Scheme to encourage eligible local and prospective practitioners to participate in training related to green and sustainable finance. Additionally, the Talent List of Hong Kong, which covers experienced financial professionals in environmental, social and governance (ESG) and in fintech, can attract them to come and settle in Hong Kong.” He concluded by emphasising the importance of developing green fintech for the future growth of the financial sector.

Ms Cheong said: “The Hong Kong government is dedicated to supporting the development of green fintech through strategic policies, investments and collaborations. Such measures will enable us to embrace the ample employment and business opportunities arising from the huge market potential. By leveraging our collective strengths, we can address the pressing environmental challenges and create a more sustainable and resilient financial ecosystem.”

Professor Tsang stated: “The CEFAR Academy (CUHK Engineering FinTech Applied Academy) seeks applied research projects in various domains of financial technology and engages our professors and students to tackle real-life problems provided by sponsoring organisations. This year, with support from the Hong Kong Monetary Authority, Cyberport and Hong Kong Science and Technology Parks, we received enthusiastic responses from sponsoring organisations and collected about 80 thematic case studies for the projects undertaken by our students in the fintech MSc programme.” He highlighted that the collaboration would benefit both sides, offering students valuable experience and providing industry practitioners with potential solutions and new business opportunities.

( Left to right) Ms. Nancy CHENG (Head of Partnership and Innovation, Hang Seng Bank) , Prof. Hon Ki TSANG (Dean of Engineering

The Chinese University of Hong Kong) , Ms Lillian CHEONG, JP (Under Secretary for Innovation Technology and Industry, The Government of Hong Kong SAR) , Prof. Rocky S. TUAN (Vice-Chancellor and President

The Chinese University of Hong Kong) , Ms. Mimi POON (General Manager, IBM China/Hong Kong Limited) , Mr. Robert Lui (Hong Kong Digital Asset Leader, Deloitte China) have joined the kick- off ceremony.

Mr. Joseph H. L. CHAN, JP ( Under Secretary for Financial Services and the Treasury, The Government of Hong Kong SAR ) delivered a keynote speech at the conference.

FINTECH SEMINAR

Topic: Innovating Together: Unlocking Value Through Fintech Partnerships

Date: 15 Oct 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

This seminar focuses on the strategic partnership achievements of Hang Seng Bank and highlights key fintech projects. It illustrates how collaboration with industry partners enhances innovation and customer experiences while streamlining operations and adapting to the evolving financial landscape. The seminar showcases successful initiatives that demonstrate the shared value created and emphasising the importance of strategic alliances in unlocking new opportunities and driving growth in the fintech sector

Speaker(s)

- Ms. Nancy Cheng , Head of Partnership and Innovation, Hang Seng Bank

Snapshots :

CEFAR ANNUAL AWARD 2023-2024 CUM TERM-END GATHERING

To recognize the outstanding performance from the MSc FinTech students who engaged in FinTech industrial project,

The CUHK Engineering FinTech Applied Research (CEFAR) Academy held the CEFAR Annual Award 2023-2024 on 20 April, arranging an award winning presentation to 6 outstanding performers from the MSc FinTech students who engaged in FinTech industrial projects, showcasing their learning experience, innovativeness and impactful result in the project throughout the academic year.

| Date : | 20 April 2024 |

| Time : | 10:30am - 02:00pm |

| Venue : | William M W Mong Engineering Building Lecture Theatre, The Chinese University of Hong Kong |

The event provided an enjoyable occasion for participants, students and judges to mingle and network.

THE COMPETITION | |

| Programme Leaders and Panel of Judges (From the left): - Prof. CK CHAN, Programme Director of the Master of Science in FinTech, CUHK; Secretary, CEFAR Academy, CUHK - Ms. Karry CHUNG, Associate Fintech Director, Fintech Facilitation Office of Hong Kong Monetary Authority - Mr. Victor YIM, Head of FinTech of Hong Kong Cyberport - Prof. Hon Ki TSANG, Interim Dean of Engineering, CUHK - Dr. HL YIU, Chief Corporate Development Officer, Hong Kong Science and Technology Park - Mr. Simon LEE, Senior Director of Client Development in FinTech, PropTech & Art-Tech, HK Applied Science and Technology Research Institute - Prof. Irwin KING, Programme Director of Master of Science in Computer Science, CUHK - Prof. Tan LEE, Associate Dean (Education) of Engineering, Head of Graduate Division of Financial Technology, CUHK | |

| Prof. Tan LEE giving out a welcoming address to start the event. | Prof. CK CHAN introducing the background and information of CEFAR Award. |

| One of the contestants Ms. Min ZHONG presenting her works. | Judges in the Q&A session, giving comments towards contestants' presentation. |

RESULT ANNOUNCING | |||

After the outstanding presentations from all 6 contestants, the panel of judges decided the competition result and annouced as follow: | |||

CEFAR Award (Diamond) | Ms. Baihui CEN Mr. Haodong HU Mr. Junhua ZHANG | CEFAR Award (Honourable Mention) | Mr. Ziheng YU Ms. Min ZHONG Mr. Chi Hin Nestor FOK |

DIAMOND | GOLD | SILVER |

| Prof. Hon Ki, TSANG presenting the award to Ms. Baihui CEN. | Award presented by Ms. Karry CHUNG to Mr. Haodong HU. | Mr. Junhua ZHANG receiving the award from Mr. Simon LEE. |

HONOURABLE MENTION | ||

| Award presented by Dr. HL YIU to Mr. Ziheng YU. | Ms. Min ZHONG receiving the award from Mr. Victor YIM. | Prof. Irwin KING presenting the award to Mr. Chi Hin Nestor FOK. |

AFTER THE EVENT | |

Everyone taking a group photo of the event. | |

| Participants enjoying beverages. | More mingling after the event. |

REAL-WORLD ASSET TOKENIZATION COMPETITION &

VISIT TO THE HONG KONG MONETARY AUTHORITY

Asset Tokenization is one of the popular topics in FinTech development. It refers to the process of converting the ownership rights to an asset to a digital form. The concept has gained popularity in recent years, particularly in Web 3 and real-world assets. In view of the growing importance of tokenization, our programme and the Hong Kong Monetary Authority (HKMA) co-organised an awrd winning competition "Real-World Asset Tokenization", sponsored by Hang Seng Bank Limited, to raise the awareness and ideas on the trendingtopic. The competition consist of 2 parts: |

| 1. Competition | : 15 April 2024 | CYT, LT5, CUHK |

| 2. Award Presntation | : 22 April 2024 | Information Centre, HKMA |

| With all 5 teams presented their thoughts and ideas on the topic clearly to the judging panel, the competition was held successfully. Let's recap the competition together. |

| Panel of Judges of the competition (from the left): - Mr. York TSANG, Associate Fintech Director, Fintech Facilitation Office, Hong Kong Monetary Authority - Ms. Nancy CHENG, Principal, Strategic Planning and Corporate Development, Hang Seng Bank Limited - Prof. CK CHAN, Secretary, CUHK Engineering FinTech Applied Research (CEFAR) Academy | |

| |

Groups presenting their ideas on the topic to the judges. | |

| |

| Everyone taking group photo after the competition. | |

REAL-WORLD ASSET TOKENIZATION COMPETITION &

VISIT TO THE HONG KONG MONETARY AUTHORITY

| With the support from HKMA, our programme arranged a visit to HKMA and was honoured to also arrange the Award Presentation at the Information Centre of HKMA on 22 April 2024. |

|  |

| Prof. CK CHAN presenting the Second Runner-up Award to Mr. Chit Wang Felix CHEUNG Mr. Chun Ming Andrew MAK | The First Runner-up Award goes to Ms. Wai Fan Fanny MOK Award presented by Ms. Nancy CHENG |

|  |

| Ms. Natalie CHAN, Fintech Director, Hong Kong Monetary Authority presenting the Award to the Champion Ms. Ashley Jeyin TAN Mr. Johnson KONG | The representatives from the co-organizers and sponsors take a group photo with the contestants. |

| Students enjoying their visit at the Information Centre of HKMA.. | |

FINTECH SEMINAR

Topic: The Role of AI in Asset Management

Date: 16 Apr 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

In this Seminar, Dr. Ma will present a few of the latest outcomes achieved through the application of AI in asset management. For predictive AI, quantamental models with AI have been applied in a public fund. While the results are promising, it remains challenging to incorporate all risk factors. For generative AI, Large Language Models (LLM) have been used to assist and streamline algo trading strategies selection and deployment. Dr. Ma will showcase a prototype model to illustrate its potential applications and associated challenges.

Speaker(s)

- Dr. Alfred Ma , Managing Director, CASH Algo Finance Group

Snapshots :

FINTECH SEMINAR

Topic: Emerging Market Trends in Digital Asset Applications

Date: 19 Mar 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

In the digital era, economies around the world are seizing opportunities presented by digital asset while ensuring risk management and regulatory compliance. In June 2023, Hong Kong's Securities and Futures Commission introduced a regulatory framework for virtual asset trading platforms which aims to support the industry's orderly and sustainable development. To delve into what lies ahead, this session will explore the significance of Hong Kong's ongoing collaboration with international markets in order to ensure that our city's digital asset and Web3 policies align with global standards, thereby fostering broader market adoption. Furthermore, we will discuss emerging market trends in digital asset applications across various industries, including topics such as tokenization, blockchain-based payment solutions, and more.

Speaker(s)

- Mr. Robert Lui, Hong Kong Digital Asset Leader, Capital Market Services Group Hong Kong Offering Services Leader, and Audit & Assurance Partner of Deloitte China - Deloitte

Snapshots :

FINTECH SEMINAR

Topic: Innovation in Asset Management

Date: 27 Feb 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

In this Seminar, Ms. Blakeney will share with us about the innovation in asset management through the experience of Franklin Templeton (FT). We will learn from her about how wealthtech has been driving innovation forward at FT. Some AI initiatives, digital assets & tokenization of funds and the Bitcoin ETF recently launched by the firm in the US, will be discussed. We will also explore together the role that the digital wealth team plays in this broad endeavour, digital distribution in asset management, and the evolving role of the advisor.

Speaker(s)

- Ms. Brit Blakeney, SVP, Digital Strategy & Wealth Management – Asia, Franklin Templeton

Snapshots :

FINTECH SEMINAR

Topic: Innovative banking solution to meet SME customers need

Date: 30 Jan 2024

Time: 5:30pm - 6:15pm

Venue: Emerald Room, CUHK Business School Town Centre (Unit B, 1/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong)

Abstract

In this presentation, we will examine the digital transformation journey of SME customers and focus on the valuable support provided by banks, specifically referencing the experience of Hang Seng. We will discuss how these banks help SMEs achieve their business goals by maximizing sales, enhancing operating efficiency, and effectively managing operating costs through the implementation of innovative banking solutions.

Speaker(s)

- Mr. John Wong, Managing Director, Head of Global Payments Solutions, Hang Seng Bank

Snapshots:

CEFAR GBA CONNECT PROGRAMME EXECUTIVE SHARING SERIES

The first talk under the newly launched CEFAR GBA Connect Programme Executive Sharing Series was held on 20 November. Mr. Hong Wei Zhu, Payment Cloud President of Yeahka shared his insights under the topic “From Payment to Metaverse – Transformation of Offline Consumption in a Decade”. Mr. Eros Ye, Programme Lead of the CEFAR GBA Connect Programme and Director of Technology Centres China, Digital Business Services of HSBC China moderated the talk. Over 70 undergraduate and postgraduate FinTech students attended the talk and shared fruitful discussions with the speaker and the moderator after the event.

|

2023 CUHK Conference on Financial Technology

Details: conference.cefar.cuhk.edu.hk

CUHK Faculty of Engineering hosts Financial Technology Conference 2023 on the governance and risk management implications of generative AI and digital assetsThe Chinese University of Hong Kong (CUHK)’s Faculty of Engineering, with sponsorship from Hang Seng Bank and Deloitte China, hosted the 2023 CUHK Conference on Financial Technology (fintech) in hybrid mode yesterday(1 November). The conference, with the theme “Generative AI and Digital Assets – Governance and Risk Management Perspectives”, attracted more than 600 attendees, including industry practitioners, government officials, regulators, academics, researchers and students, who delved into the governance and risk management issues in connection with generative AI and digital assets. The event was supported by CUHK Business School, CUHK Engineering FinTech Applied Research Academy (CEFAR Academy), the Department of Systems Engineering and Engineering Management, and the Centre for Financial Engineering. The officiating guests at the conference were Professor Alan K.L. Chan, Provost of CUHK; Mr Joseph H.L. Chan, JP, Under Secretary for Financial Services and the Treasury in the government of the Hong Kong SAR; Professor Tsang Hon-ki, Interim Dean of CUHK’s Faculty of Engineering; Mr Ivan K.B. Lee, JP, Commissioner for Innovation and Technology in the government of the Hong Kong SAR; Ms Vivien W.M. Chiu, Chief Operating Officer of Hang Seng Bank; and Mr Ted Ho, Partner of Deloitte China. Experts from the banking, technology and legal sectors together with CUHK scholars delivered three panel discussions, a series of talks and a fireside chat session, sharing their insights on the opportunities, risks, challenges and governance associated with generative AI and digital assets, and how the capabilities of these advanced AI technologies can be enhanced through academia-industry partnership. In his opening address, Professor Alan K.L. Chan, Provost of CUHK, said, “CUHK is delighted to organise this remarkable conference on our campus, which provides a platform for finance and technology professionals, regulators and government leaders, academics, researchers and students to engage in insightful discussions and to exchange knowledge.” He stressed that “Hong Kong needs to nurture fintech talents who can address challenges related to emerging technologies and new transaction models. By offering the city’s first Fintech bachelor’s and master’s degrees, CUHK is the pioneer in fintech education in Hong Kong.” “With tremendous access to potential clients, business partners and investors here, as many financial institutions have their regional headquarters or biggest regional presence in the city, Hong Kong is the ideal place for fintech companies to start up and scale up,” said Mr Joseph H.L. Chan, JP, Under Secretary for Financial Services and the Treasury of the Hong Kong SAR government. “But this mission is not solitary; it is a collaborative effort with vital partners like CUHK, whose contributions to talent development and innovative research empower Hong Kong to continually push the boundaries of fintech possibilities.” He further emphasised the city’s commitment to financial inclusion, highlighting that from the launch in October 2022 of the Commercial Data Interchange, a Hong Kong Monetary Authority initiative to encourage data sharing, to the end of June 2023, it had processed over 4,900 loan applications, totalling about HK$4.4 billion. Professor Tsang Hon-ki, Interim Dean of CUHK’s Faculty of Engineering, added, “CUHK’s Faculty of Engineering recognises the importance of collaboration with industry and regulatory bodies to enhance talent development and to address potential problems and solutions associated with the latest technologies. We have been keen on fostering a close relationship with regulators and the fintech industry. Under the CEFAR Academy established in 2020, applied research projects in various domains of financial technologies address real-life problems identified by sponsoring organisations. This year, we received enthusiastic responses from those organisations, and collected a record number of over 70 problem statements.” Ms Vivien Chiu, Chief Operating Officer at Hang Seng Bank, said, “Innovation is a cornerstone of Hang Seng Bank’s brand values. We operate a bank-wide innovation programme, Fintecubator, dedicated to embracing creative new methods of work and integrating fintech solutions. Our aim is to equip staff with future-ready skills and employ emerging technologies to enhance our customer services. Our collaboration extends to partners such as regulators and academics, fostering new ideas and talent development in Hong Kong. Hang Seng is committed to further supporting fintech development locally and in the Greater Bay Area by spearheading industry projects and making meaningful contributions to the community.”

Officiating guests: (From left) Ms Vivien Chiu, Chief Operating Officer of Hang Seng Bank, Mr Wai Ming Lau, Assistant Commissioner of Innovation and Technology (representing Mr Ivan Lee, Commissioner for Innovation and Technology), Mr Joseph Chan, Under Secretary for Financial Services and the Treasury, Professor Alan K. L. Chan, CUHK Provost, Professor Tsang Hon-ki, CUHK’s Interim Dean of Engineering, and Mr Ted Ho, Partner of Deloitte.

Professor Alan K. L. Chan, CUHK Provost, delivers a welcome speech.

Mr Joseph Chan, Under Secretary for Financial Services and the Treasury, delivers a speech at the conference’s opening ceremony.

Professor Tsang Hon-ki, Interim Dean of Engineering, said that the Faculty of Engineering has been keen on fostering a close relationship with regulators and the fintech industry.

Mr Ivan Lee, Commissioner for Innovation and Technology, joins a tour of the booths with other guests.

The conference attracted more than 600 attendees, including industry practitioners, government officials, regulators, academics, researchers and students, who explored generative AI and digital assets’ governance and risk management implications. |

CEFAR MENTORSHIP PROGRAMME NETWORKING DINNER

To enhance the communication among mentors and mentees, the CEFAR Academy held a mentorship programme networking dinner on 23 May following the Fintech Seminar Series. The guest speaker of the seminar, Ms. Charlotte Wong, HSBC Chief Information Officer, also joined the dinner as the Guest of Honour. All participants had a great time and led fruitful discussions at the dinner.

In the 2022-23 academic year, a mentorship programme has been launched as one of the initiatives of the CEFAR Academy for students of the Master of Science in Financial Technology. The seven students selected for the mentorship programme were among the recipients of the UGC’s Targeted Taught Postgraduate Fellowships Schemes. They were each paired with a mentor who is a member of the Advisory Committee of the CEFAR Academy. The mentorship programme aims to connect students with industry and fintech leaders to advance and accelerate their career goals and personal advancement.

CEFAR Awards 2022-23 Presentation Ceremony cum Tea Reception

The CEFAR Annual Awards aim to recognize students who have engaged in a FinTech industrial project as lined up by the CEFAR Academy (i.e. CEFAR Project) for attainment of academic credits and delivering outstanding performance by demonstrating their ability and skills in analysing a real-life business problem and applying extensive knowledge and concepts to derive proper solutions and deliverables for the project.

In the academic year 2022-23, four awards have been introduced in order to recognize the students who had excellent results in delivering the projects with impact in specific areas.

The four CEFAR awards are namely:

• CEFAR Award (Diamond)

• CEFAR Award (Gold)

• CEFAR Award (Silver)

• CEFAR Award (Honorable Mention)

Selected candidates were invited to attend a poster presentation session introducing their projects to the judging panel for competition of the awards. The poster presentation session and award presentation ceremony were held on 22 Apr.

Awardees:

LIAO Zhongmin CEFAR Award (Diamond) |  |

LI Tingxuan CEFAR Award (Gold) |  |

ZHANG Jiahao CEFAR Award (Silver) |  |

JIANG Xueting CEFAR Award (Honorable Mention) |  |

(From left to right:

- Prof. Martin D.F. Wong, Dean, CUHK Faculty of Engineering

- Mr. David Chan, Chief Operating Officer, HK Applied Science and Technology Research Institute

- Mr. Eric Chan, Chief Public Mission Officer, HK Cyberport

- Ms. Karry Chung, Manager of Hong Kong Monetary Authority

- Prof. Tan Lee, Associate Dean, CUHK Faculty of Engineering

- Prof. Chun Kwong Chan, Programme Director, MSc FinTech, CUHK Faculty of Engineering)

CEFAR Award Presentation Ceremony cum Tea Reception

The CEFAR Annual Awards aim to recognize students who have engaged in a FinTech industrial project as lined up by the CEFAR Academy (i.e. CEFAR Project) for attainment of academic credits and delivering outstanding performance by demonstrating their ability and skills in analysing a reallife business problem and applying extensive knowledge and concepts to derive proper solutions and deliverables for the project.

In the academic year 2021-22, three awards have been introduced in order to recognize the students who had excellent results in delivering the projects with impact in specific areas. The three CEFAR awards are namely:

• Business Model Innovation Award

• Technology Innovation Award

• Industry Adoption Award

An award presentation ceremony was held on 6 Feb.

HAN Tianyang

Award: Industry Adoption Award

Sponsor company: Alphabrain HK Limited, with the project title of Evolution of Alpha Hotpot

ZHANG Jiawei, Jenny

Award: Business Model Innovation Award

Sponsor company: Hang Seng Bank, with the project title of Visionary Risk Analytics Engine

CHEN Ming

Award: Technology Innovation Award

Sponsor company: RPA HK Limited, with the project title of Build a Portfolio of Automated Process

香港:下一個虛擬資產中心?

探討虛擬資產的發行/代幣化/交易/支付/資產管理/存管及各種金融創新帶來的機遇。希望這次能把政府決策高層,業界精英,商會領袖,及一些中大創業公司聚集,一起來討論香港未來虛擬資產生態的發展!

Date and time:

Location: TOWER 535 1001B,10/F, 535 Jaffe Road Hong Kong, HKI

Registration: https://www.eventbrite.com/e/492746075777

議程[下午2點至6點]

歡迎和介紹 Welcome and Introduction

爐邊談話 Fireside Chat 1

爐邊談話 Fireside Chat 2

簡報 Presentation

休息 Networking Break

專題討論1:香港虛擬資產生態圈發展 HK Virtual Asset Ecosystem Development

專題討論2:虛擬資產/金融科技初創公司對談 Virtual Asset/Fintech Startups Panel

2022 CUHK Conference on Financial Technology

Details: conference2022.cefar.cuhk.edu.hk

CUHK Faculty of Engineering holds Financial Technology

Conference 2022 on new developments in the digital

economy: metaverse, web3 and beyond

The Chinese University of Hong Kong (CUHK)’s Faculty of Engineering hosted the 2022 CUHK Conference on Financial Technology (FinTech) in hybrid mode today (3 November). The conference, “New developments in the digital economy: metaverse, web3 and beyond”, attracted more than 700 attendees, including industry practitioners, academics, researchers, government officials and financial regulators, to explore the potential of the metaverse and web3 technologies. The event was supported by CUHK Business School, CUHK Engineering FinTech Applied Research Academy (CEFAR Academy), Department of Systems Engineering and Engineering Management, Centre for Financial Engineering, and The Asia-Pacific Institute of Business, and sponsored by Hang Seng Bank, CASH Financial Services Group and HKT. Officiating guests at the conference were Professor Rocky S. Tuan, CUHK Vice-Chancellor and President, Mr Joseph Chan, the Hong Kong government’s Under Secretary for Financial Services and the Treasury, Ms Rebecca Pun, its Commissioner for Innovation and Technology, Mr Laurie Pearcey, CUHK Associate Vice-President (External Engagement and Outreach), Professor Martin D.F. Wong, Dean of CUHK’s Faculty of Engineering, Professor Zhou Lin, Dean of CUHK Business School, and Ms Vivien W.M. Chiu, Hang Seng Bank’s Chief Operating Officer. CUHK scholars and experts from the banking, technology and insurance services delivered three panel discussions, a series of featured talks and a fireside chat, giving their insights on the metaverse ecosystem and its industry applications, the transformation of industries in the age of web3, innovation in the digital economy, risks and opportunities, and other related topics (please see appendix for the guest speaker list). Professor Rocky S. Tuan, CUHK Vice-Chancellor and President, said, “This conference is part of the FinTech Education Series, which is a satellite event of the Hong Kong FinTech Week 2022, as well as the sixth annual FinTech conference hosted by CUHK. FinTech is an essential area of Hong Kong’s future economy, and is a great example of where the city can serve as the connective tissue between the rest of the world and the Guangdong-Hong Kong-Macao Greater Bay Area. If FinTech is to realise its full potential, universities have a critical enabling role in powering discoveries and adding technical and education know-how and making industry more competitive.” Mr Joseph Chan, Under Secretary for Financial Services and the Treasury, said, “Hong Kong is Asia’s leading international financial centre, leading on various league tables in the region. FinTech companies can enjoy tremendous access to potential clients, investors and business partners. With the advantages of our international network and preferential access to the mainland market, as well as our friendly and supportive measures for FinTech development, Hong Kong is the destination choice for FinTech companies to start up and scale up.” Ms Rebecca Pun, Commissioner for Innovation and Technology, said, “To embrace the opportunities, Hong Kong must further enhance its I&T ecosystem and this process would surely be facilitated with the country’s full support as illustrated in the National 14th Five-Year Plan and the Government’s firm commitment to foster Hong Kong’s development into an international I&T centre. We are going full speed ahead to consolidate our strengths in research and development capabilities and facilitate collaboration among industry, academic and research sectors.” Professor Martin D.F. Wong, CUHK’s Dean of the Faculty of Engineering, added, “CUHK is keen to strengthen its educational exchanges and cooperation with industry and the government, and to explore new opportunities in FinTech development. Talent, to be sure, is crucial in capturing FinTech’s promise, today and tomorrow. In CUHK’s Faculty of Engineering, we have launched FinTech programmes at undergraduate and master’s levels, developing a steady pipeline of FinTech talents equipped with strong applied research capabilities to meet industry demands.” Ms Vivien Chiu, Hang Seng Bank’s Chief Operating Officer, said, “FinTech is a major theme in the future development of banking. Hang Seng’s early and ongoing investments in technology have made us a pioneer in digitising our banking services in Hong Kong. Through the smart use of technologies and innovative digital solutions, we are continually enhancing our ability to provide customers with greater convenience, more secure experiences and personalised choices. Hang Seng will continue to support and enable Hong Kong’s FinTech development by participating in industry projects and applying our expertise in serving the community.” Attachment |

Mr Joseph Chan, Under Secretary for Financial Services and the Treasury Bureau delivers his speech at the conference’s opening ceremony via a pre-recorded video.

Ms Rebecca Pun, Commissioner for Innovation and Technology addresses at the conference.

Professor Martin D.F. Wong, Dean of CUHK’s Faculty of Engineering says that CUHK is keen to strengthen its educational exchanges and cooperation with industry and the government, and to explore new opportunities in FinTech development.

The conference attracted more than 700 attendees, including industry practitioners, academics, researchers, government officials and financial regulators, to explore the potential of the metaverse and web3 technologies. |

2022 CUHK FinTech Conference Booklet:

2021 CUHK Conference on Financial Technology

Details: https://conference2021.cefar.cuhk.edu.hk/

CUHK FACULTY OF ENGINEERING HOLDS FINANCIAL TECHNOLOGY

CONFERENCE 2021: TOWARDS A DIGITALISED SOCIETY -

DIGITAL ASSETS & PLATFORMS

The Faculty of Engineering of The Chinese University of Hong Kong (CUHK) hosted the “2021 CUHK Conference on Financial Technology (FinTech)” in hybrid mode today (2 November). This special event was sponsored by the Hang Seng Bank and supported by the CUHK Engineering FinTech Applied Research Academy (CEFAR Academy), the Department of Systems Engineering and Engineering Management, the Centre for Financial Engineering (CFE), the Centre for Innovation and Technology (CINTEC), and CUHK Business School. The conference titled “Towards a Digitalised Society – Digital Assets & Platforms” attracted 800 attendees including industry practitioners, academicians, researchers, government officials and regulators to discuss the developments in digitalisation of assets and platforms which are playing important roles in business transactions. The conference was officiated at by Professor Rocky S. TUAN, Vice-Chancellor and President, CUHK, Mr. Joseph CHAN, JP, Under Secretary for Financial Services and the Treasury Bureau, Ms Rebecca PUN, JP, Commissioner for Innovation and Technology, Professor Martin D.F. WONG, Dean, Faculty of Engineering, CUHK, Professor Lin ZHOU, Dean, CUHK Business School, and Mrs. Eunice CHAN, Chief Operating Officer, Hang Seng Bank. CUHK scholars and experts from banking, technology, insurance, and entertainment sectors were invited to share their views on the development of stablecoins, digital currencies, cyber security, digital platforms for supply chains, digitisation of cash management, and other related topics. Professor Rocky S. TUAN, Vice-Chancellor and President of CUHK said, “The University is keen to strengthen its educational exchanges and cooperation with industry and the government, and to explore new opportunities in FinTech development. We are confident that the tripartite partnership between the government, academia and industry will continue to stimulate growth of the FinTech ecosystem and further galvanise the development of FinTech in Hong Kong and beyond.” Mr. Joseph CHAN, JP, Under Secretary for Financial Services and the Treasury Bureau, said, “Hong Kong ranked first in Asia and third in the world in the Global Financial Centres Index published last month. With the advantages of our international network and preferential access to the market of mainland China, as well as our friendly and supportive policy measures for FinTech development, Hong Kong is the destination choice for FinTech companies to start up and scale up. Many financial institutions and multinational companies set up their Asia regional headquarters or their biggest Asian business presence here in Hong Kong. This is the ideal place for the development of FinTech business as FinTech companies enjoy tremendous access to potential clients, investors and business partners.” Ms Rebecca PUN, JP, Commissioner for Innovation and Technology, said, “We are pushing forward the development of FinTech in our pursuit of making Hong Kong an international innovation and technology hub. We will continue to invest in infrastructure, research and development, as well as talent. Together with our country’s staunch support for Hong Kong’s I&T development, there are many opportunities for our FinTech community to tap into.” Professor Martin D.F. WONG, Dean, Faculty of Engineering, CUHK, said, “This conference is one of the core events of the HK FinTech Week 2021. The Faculty of Engineering is pleased to host this conference and to take full advantage of this opportunity to bring together the academia and industry participants to explore and to carry out fruitful discussions on this year’s theme ‘Towards a Digitalised Society’ and to promote future collaboration opportunities.” Professor Lin ZHOU, Dean, CUHK Business School, said, “CUHK Business School is delighted to be part of this year’s conference which sees a strong collaboration between our University and the industry. Such partnership is essential for the creation of new opportunities in the FinTech sector.” Mrs. Eunice Chan, Chief Operating Officer, Hang Seng Bank, said, “FinTech is a key element in the digitialisation of society. Hang Seng is actively collaborating with FinTech ecosystem partners and participating in the development of FinTech solutions for society. We are delighted to be partnering with The Chinese University of Hong Kong and to be helping to nurture FinTech talent through designated industrial projects, internships and scholarships. We look forward to these bright minds sharing their creative ideas with Hang Seng and to seeing them further develop these ideas into projects that will benefit our community.” Other guest speakers participating in the two panel discussion sessions included Mr. Raymond CHENG, Advisory Committee Chairman, CUHK Engineering FinTech Applied Research Academy, Ms. Brit BLAKENEY, Executive Director, Innovation & Ecosystems, DBS Bank (HK) Ltd, Mr. Thor CHAN, CEO, AAX, Mr. Nike KONG, Chief Information Officer, Hang Seng Bank. Mr. Henry CHONG, Chief Executive Officer, FUSANG, Mr. Alun JOHN, Asia Regulation Correspondent, Reuters News, Mr. Joseph CHAN, Chief Digitisation Officer, Hong Kong Monetary Authority, Mr. Patrick KHONG, Head of Data and Architecture, Hang Seng Bank, Ms. Rebecca SHAO, Head of Data and Research and Head of Asia Pacific, The Floor, and Ms Cristina NG, Senior Manager, Payment Services, Open Rice. The speakers shared their views on the current and future developments of digital assets and platforms in the FinTech age. A number of demonstrations were made in the conference, including “Unsupervised Detection of Money Laundering Activities via Diffusion Model” initiated by the academicians and the students of the Department of Systems Engineering and Engineering Management, CUHK and projects in receipt of CEFAR Awards for solutions by FinTech applications in the banking services. About the CUHK Engineering FinTech Applied Research Academy (CEFAR Academy) About the Department of Systems Engineering and Engineering Management, CUHK About CUHK Business School About the Centre for Financial Engineering, CUHK About the Centre for Innovation and Technology, CUHK |

Professor Rocky S. TUAN, Vice-Chancellor and President, CUHK delivers a welcoming speech.

A group photo of the Guest of Honour, speakers, sponsors and representatives from supporting organisations and the organising committee.

A number of demonstrations are presented in the conference. |

\

\

(From left) Professor Lin ZHOU, Dean, CUHK Business School, CUHK, Mr. Laurie PEARCEY, Associate Vice-President, CUHK, Ms Rebecca PUN, JP, Commissioner for Innovation and Technology, Professor Rocky S. TUAN, Vice-Chancellor and President, CUHK, Mr. Joseph CHAN, JP, Under Secretary for Financial Services and the Treasury Bureau, Mrs. Eunice CHAN, Chief Operating Officer, Hang Seng Bank, and Professor Martin D.F. WONG, Dean, Faculty of Engineering, CUHK.

(From left) Professor Lin ZHOU, Dean, CUHK Business School, CUHK, Mr. Laurie PEARCEY, Associate Vice-President, CUHK, Ms Rebecca PUN, JP, Commissioner for Innovation and Technology, Professor Rocky S. TUAN, Vice-Chancellor and President, CUHK, Mr. Joseph CHAN, JP, Under Secretary for Financial Services and the Treasury Bureau, Mrs. Eunice CHAN, Chief Operating Officer, Hang Seng Bank, and Professor Martin D.F. WONG, Dean, Faculty of Engineering, CUHK.