In the 2022-23 academic year, the CEFAR Academy has secured 57 projects from 30 sponsor organizations. Under the “Fintech 2025” strategy, Hong Kong Monetary Authority (HKMA) has launched the Industry Project Masters Network (IPMN) scheme with the aim of grooming fintech talents by providing opportunities to postgraduate students to work on banks’ fintech or industry projects and gain hands-on experience and skills. Out of the 57 projects secured in 2022-23 academic year, 24 are offered via HKMA IPMN scheme, soliciting the support from 17 sponsor organizations.

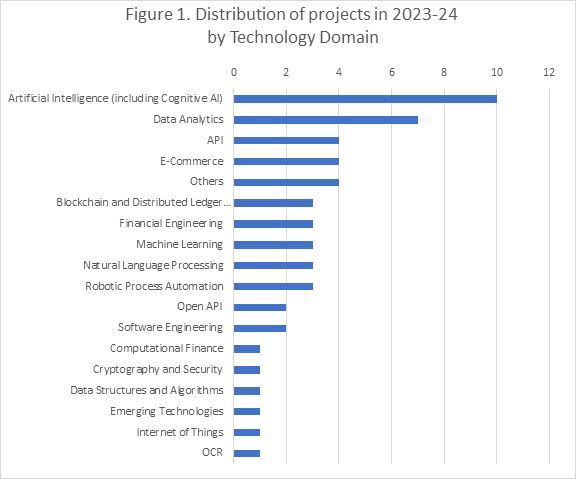

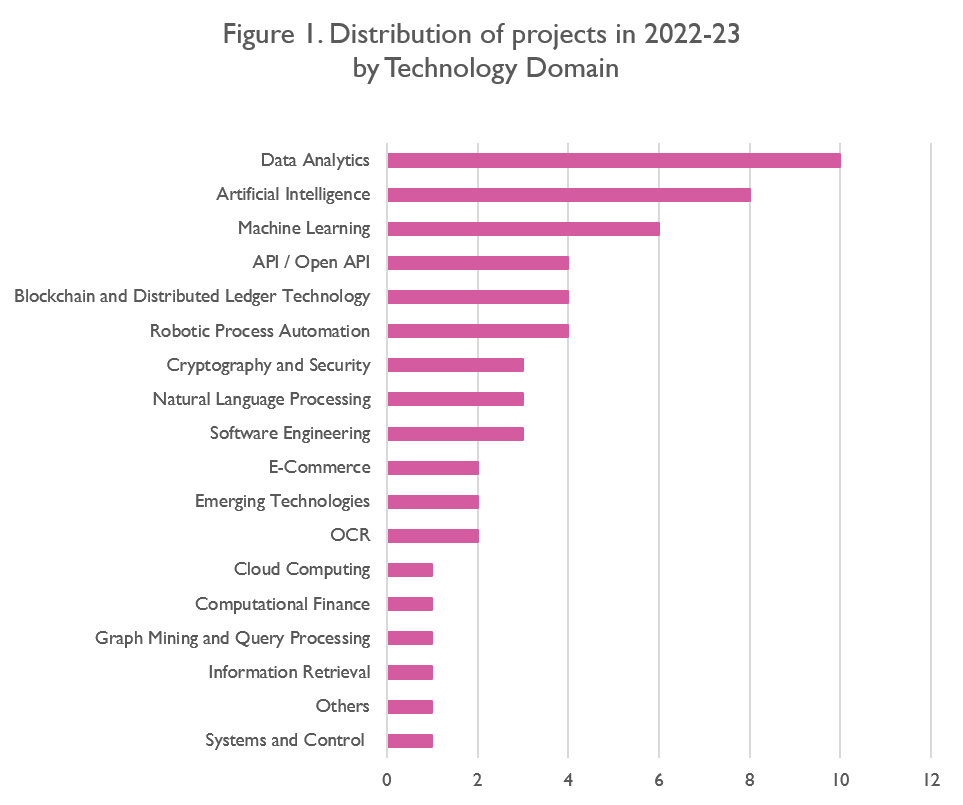

The scope of the applied research projects are categorized by Technology Domains and Business Domains respectively as follows:

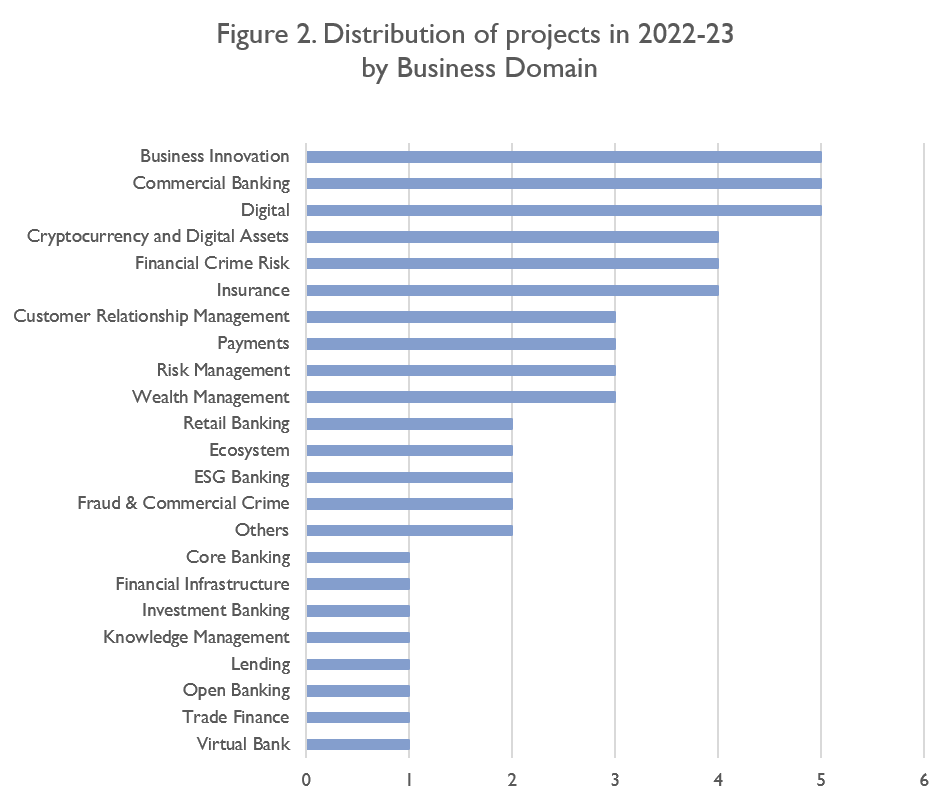

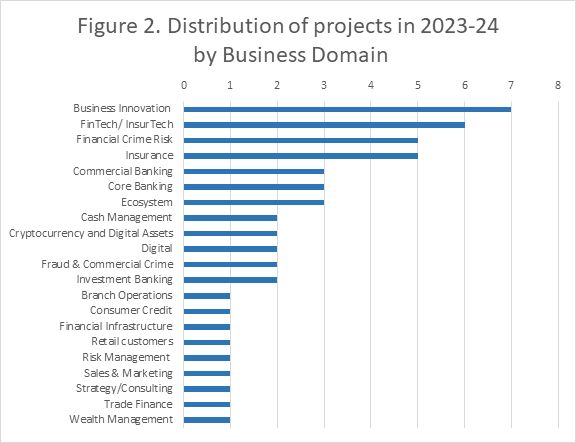

In terms of Business Domains, the scope of the applied research projects are categorized as follows: